Trading platforms are essential in today’s fast-changing financial markets. Trading platforms like Fincompose provide smooth, efficient trading for individual investors, institutional traders, and financial institutions. This article examines trading platforms like the platform’s features, advantages, and influence on market accessibility, liquidity, and technological improvements in today’s financial markets. We can learn about financial trading’s future by studying trading platforms’ development and influence.

Trading Platform Evolution ft. Fincompose

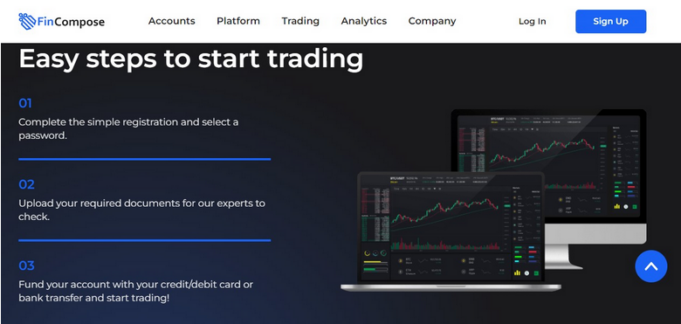

Trading platforms have developed from physical trading floors to real-time computerized systems. Electronic trading platforms automated trade execution, reduced transaction costs, and improved market efficiency in the financial sector. Fincompose and other modern trading systems meet market players’ different demands.

Trading Platform Advantages

Fincompose’s many features and advantages improve the trading experience for individuals and institutions. These systems give real-time market data, including price quotations, trading volumes, and historical charts, so that traders can make educated choices. Limit orders, stop orders, and trailing stops help traders automate their trading techniques and control risk.

Trading platforms include stocks, bonds, commodities, currencies, and derivatives. Diversification lets traders capitalize on opportunities across asset types. Trading platforms also provide technical indicators and fundamental data for market analysis.

Access and Liquidity

Trading platforms improve market liquidity and accessibility. Financial markets were formerly restricted to institutional and wealthy investors. Fincompose has democratized market access, letting regular investors trade. These platforms let ordinary investors sell directly in financial markets without middlemen, lowering transaction costs.

Trading platforms boost market liquidity by allowing direct market access. They provide a worldwide platform for efficient exchanges by connecting buyers and sellers. Liquidity reduces bid-ask spreads, price slippage, and transaction execution time for everyone. Liquidity improves price and market efficiency.

Technological Progress

Fincompose uses technology to enhance trading. Cloud computing and high-speed internet access allow platforms to deliver real-time data and trade execution, giving traders up-to-the-second information and speedier order execution.

Trading systems now enable smartphone and tablet users to trade anytime, anywhere. Fincompose’s mobile trading applications let traders to watch markets and conduct trades on the fly, making them more popular.

Algorithmic trading allows users to create and execute automated trading strategies. Algorithmic trading algorithms examine market data, find trends, and execute trades automatically based on rules. Automation and AI have improved trade efficiency and decreased errors.

Social trading tools enable users to exchange trade ideas, techniques, and observations. Social trading lets new traders learn from expert traders and copy their tactics, creating a collaborative and instructive trading environment.

End Note

Today’s financial markets need trading systems like Fincompose. They have made trading more accessible, liquid, and technologically advanced for people and institutions. Trading platforms provide traders with real-time data, sophisticated order types, and various financial instruments to make educated judgments. trade platforms will shape economic trade and democratize global markets as technology advances.