In recent years, online trading, or ‘eTrading,’ has emerged as a powerful force, symbolizing the democratization of financial markets. Once the realm of institutional investors, like large banks, funds, and brokerages, the financial landscape is now experiencing a surge in participation from retail investors. These everyday individuals increasingly take charge of their financial destinies through digital platforms, reshaping the traditional dynamics of investment and trading.

MetaTrader 4: The Gateway to Online Trading

Source: Financial Times Equity Indices November 2023

The widespread adoption of platforms such as MetaTrader 4 (MT4) is at the heart of this revolution. Esteemed by both novice and seasoned traders, MT4 has revolutionized how individuals engage with the financial markets. Its user-friendly interface and robust analytical tools simplify the trading process. The platform supports live and demo accounts, offering a practical learning environment for beginners and a sophisticated platform for experienced traders.

An integral part of the online trading universe is the forex market. With a staggering daily volume, forex trading involves 39 different currencies. As of 2022, the daily volume for the USD alone was nearly six billion U.S. dollars, significantly higher than that of the Euro. The forex market operates on the fluctuations of currency interest rates, offering opportunities to profit from the varying performance of currencies like the U.S. dollar against others. This market, not frequently measured, only releases turnover figures once every three years, highlighting the USD’s dominance in global currency trading.

The Impact of Retail Trading

The transformative power of retail trading was strikingly evident in the Gamestop and AMC Entertainment events of 2021. These episodes, driven by retail investors coordinating through online trading apps and social media, led to a substantial increase in the stock prices of these companies. This movement not only disrupted established market trends but also showcased the collective influence of individual investors.

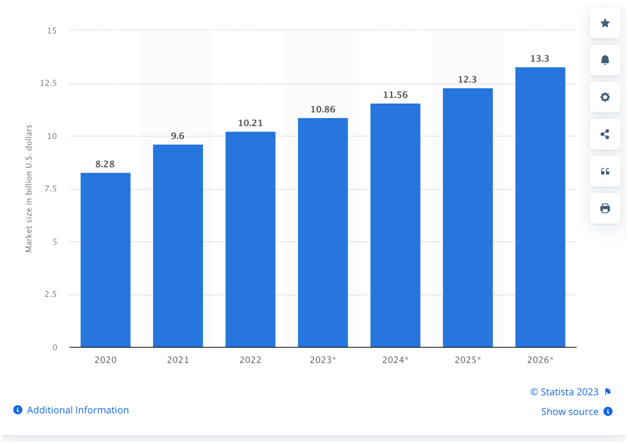

The global online trading market is on an upward trajectory. According to Statista, the market is projected to grow at a compound annual rate of 6.4%, potentially reaching around $13.3 billion by 2026. This growth is fueled by rising interest among millennials and increased platform users, with brokers like Robinhood leading the charge. Factors such as a low-cost business model, technological integration, and effective use of social media have been instrumental in this expansion.

Key Aspects of Modern Trading Platforms

- Security: Security is a top priority for high-quality trading platforms, particularly for traders investing substantial funds. These platforms are typically regulated and licensed, providing a secure environment to protect traders’ investments.

- Functionality and Available Features: Modern platforms offer swift order execution and a variety of trading tools, essential for fast-moving markets like Forex. They also enable traders to experiment with new strategies in simulated environments before applying them with real funds.

- Reliability: Reliability is crucial, especially for platforms used by aggressive traders who make frequent, large trades. The best platforms ensure stable performance, even during high market volatility or global economic events.

- User-Friendly Interface: A user-friendly interface is key, allowing for easy order placement and effective trade management. These platforms feature one-click trading and straightforward navigation, making them accessible to traders of all experience levels.

- Average Trading Costs: While trading involves some costs, effective platforms offer a balance between fees and the quality of the trading experience. It’s important to choose a platform with transparent and reasonable costs.

- Automatic Trading: Not all platforms provide automated trading options, but those can enhance the trading experience with algorithmic suggestions or custom automated trading conditions. However, these features should be carefully evaluated to ensure profitability.

What Fuels the Online Trading Phenomenon?

The advancement of technology has been a pivotal factor in the growth of online trading. It has made investing more accessible, efficient, and economical. Platforms now offer real-time data, comprehensive industry reports, and instant trading notifications, making them a compelling alternative to traditional brokerages. For instance, in 2021, Interactive Brokers reported an average of 3,905 trades per day, significantly higher than previous years, underscoring the increasing activity in online trading.

As of 2023, about 61% of adults in the United States are engaged in the stock market, with many opting for neo-brokers to facilitate their trading activities. Despite the enduring appeal of traditional investment options like bonds, real estate, and gold, the stock market continues to attract diverse investors. This reflects a broader shift in investment strategies, where people seek security and growth opportunities in the dynamic realm of stocks.

A New Era of Financial Participation

The landscape of finance is witnessing a significant transformation. Retail trading, powered by platforms like MetaTrader 4 and buoyed by technological advancements, represents a new era in the financial world. It’s not merely a passing trend but a fundamental shift in how individuals interact with the markets. As people gain greater access and control over their investments, the barriers that once defined the financial markets disappear, leading to a more inclusive and democratized financial ecosystem.